Health Care Sharing Ministries: Blessing or Future Crisis?

One of the most significant issues of the recent mid-term elections was healthcare. The overwhelming concern is the cost. The lack of control over price has turned into a blame game. Doctors, hospitals, insurance companies, pharmaceutical companies, and politicians blame each other for the ever-increasing cost. With much of the public frustrated with the entire healthcare system, more and more people are turning to alternatives such as health care sharing ministries. However, are health care sharing ministries the answer to everyone's healthcare issues? Will the flow of money into these organizations turn their good intentions into disappointment and frustration for those that buy into the programs?

The price of being human is mortality. Just like Adam whom God made from dust and returned to the earth, so is the future of all of us. And those that accept Jesus as their savior have a life beyond that. However, between birth and death comes life. An overwhelming number of Americans are very concerned about how to care for their health during their life: "Fifty-five percent of Americans worry a great deal about the availability and affordability of healthcare" (Jones, 2018).

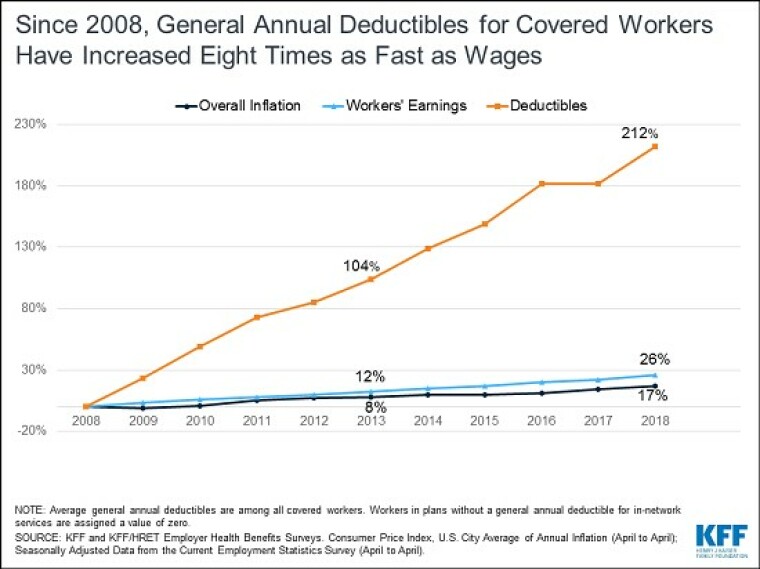

In 2010 we saw Obamacare enacted by Congress and it did get more people insured. However, it did very little to slow the rise in healthcare cost, pharmaceutical cost and health insurance premiums. The Kaiser Family Foundation reports that "annual family premiums for employer-sponsored health insurance rose 5 percent to average $19,616 this year" (KFF, 2018). Along with the increased cost of health insurance is the increase of out-of-pocket deductibles that people are paying for healthcare. You can see in the accompanying graph that deductibles for healthcare have increased eight times as fast as people's income.

To make matters worse, Obamacare mandated that every American have healthcare insurance or pay the penalty for nonparticipation. This individual mandate for every American to be covered by health insurance was repealed in 2017 and will cease to be a mandate in 2019 (Brady, 2017).

As many people's frustration with increasing healthcare cost has grown, the interest in alternatives to traditional health insurance has increased as well. The answer to many prayers for ways to afford healthcare has come in the form of health care sharing ministries [HCSMs]. About 40 years ago, Christians who were inspired by Paul the Apostle banded together to share each other's medical care expenses and created one of the first HCSMs that was open to any Christian, Christian Healthcare Ministries (CHM, 2018). Paul wrote, "share each other's burdens, and in this way obey the law of Christ" (Galatians 6:2, NLT). Other HCSMs, such as Solidarity Healthcare, base their mission on Matthew the Apostle's message to heal the sick (Matthew 10:8). Solidarity Healthcare follows the doctrine of the Roman Catholic Church. Program members are not required to be Catholic, however they must agree to follow the morals of Catholic teaching.

With the idea of Christians working together to help each other pay for medical expenses and attaining healthcare prices significantly lower than regular health insurance, HCSMs have flourished. Today, over 1 million Christians are participating in HCSMs (Alliance of HCSMs, 2018). However, it is essential to understand that HCSMs are not health insurance. That is such an important point to realize it is worth repeating: HCSMs are not health insurance.

How Health Care Sharing Ministries work

From a Christian perspective, HCSMs are a shining example of Christian love and care. Members within the programs share each other's medical expenses. Each ministry has rules for participation and payment. Common across plans is the requirement for each member to have a regular monthly fee. In addition to the regular monthly payment is a variable share expense. The shared expense is based on the medical expenses of members. Each plan differs somewhat in structure; however, the cost is usually about half the price of traditional health insurance. Those with pre-existing conditions are not denied participation. That said, those with pre-existing conditions should pay close attention to the rules of the HSCM they choose. For those with pre-existing conditions, the amount the ministry will pay in the beginning years is capped. Usually, after three years, the caps are removed, and benefits are paid at the regular member level. Besides sharing medical expenses, members are asked to pray for each other, and many send notes of encouragement to one another.

People with little or no pre-existing conditions tend to benefit the most from HCSMs. An excellent way to determine the practicality of HCSMs for people with pre-existing conditions is to look at your future prognosis. If you have a chronic illness or disease that is managed well and has a stable expense, HCSMs are still a good option. For those that have borderline conditions such as high cholesterol, high blood pressure or challenges with weight control, some HCSMs are the motivation that you need to improve your health. You may be required to work with a program advocate that will coach you along the way to better health. If you do not participate and discontinue unhealthy habits, you may be dropped from the program. HCSMs consider the biblical perspective that the body is a temple and you should treat it well. If you abuse God's gift to you, the program is not a good fit for you.

Some plans such as Christian Healthcare Ministries will also offer their program to groups as an alternative to group employer health insurance. An essential factor in providing HCSMs to a group is that all of the participants must still agree to an affirmation of Christian faith. With some smaller companies such as family run businesses, Churches or Christian schools, a statement of faith is not a problem. However, with some larger, diverse employers, it may be a problem. Additionally, the cost of HCSMs is not a tax-deductible expense for individuals. If an employer pays for the program, its cost would more than likely be taxable income to the employee. If the program is offered on a group basis, the business owner or administrator should discuss the tax implications of the program with their CPA or tax attorney.

The downside of Health Care Sharing Ministries

For whom is an HCSM not good? Anyone who requires a high level of healthcare utilization would not be a good candidate for HCSMs. Also, anyone with a health condition that has a probability of increasing in cost over the next three years would not be a good match for HCSMs. While most of the programs do not exclude any Christian, the programs do limit what will be paid for pre-existing conditions.

If a future illness develops and the HCSM determines that the health disorder was due to a pre-existing condition, they may deny payment. For example, in 2006 the First Judicial District Court in Montana granted a summary judgment motion against Christian Care Ministry, better known as Medi-Share. The judgment was on behalf of a minister whose claim for heart surgery had been denied because it was based on a pre-existing condition (Goe, 2018). Medi-Share was ordered to pay for the cost of the minister's heart surgery.

If you are considering an HCSM, it is essential to understand that their future is uncertain. The cost has been a primary factor in the growth of the programs. However, the legal requirement for every person to have insurance or face a penalty was a significant catalyst for people to use HCSMs. The programs gave people concerned about the financial penalty for not having health insurance a way to opt out of Obamacare legally. In 2017, Congress repealed the mandate for Obamacare coverage beginning in 2019. It is unclear whether people will continue participation in HCSMs when they are no longer legally required to have healthcare coverage. Changing federal regulations are not the only pressure that HCSMs face. "To date, 30 states have passed some kind of legislation exempting HCSMs from state insurance regulation" (Goe, 2018). The remaining 20 states can legally pursue HCSMs as if they were non-licensed insurance companies. Plus, as HCSMs expand, states that allowed an exemption to insurance regulations may reverse their exemptions.

Will HCSMs survive without the Obamacare mandate? The size of the program will make a big difference. A few very sick people could doom a small HCSM because there would not be enough participants to share the cost at a reasonable level. Some HCSMs are quite small, only dealing with several thousands of dollars, while others are substantial, handling millions of dollars. If a ministry fails financially, members are still responsible for healthcare expenses they incur. If you want to investigate a ministry's finances, you can request copies of financial statements. For an HCSM to legally be considered a non-profit, they are required to undergo an annual audit from an independent auditor. Copies of those financial statements may be available if you request them. Also, since all non-profit entities are required to file an annual Form 990 tax return, you can research past tax returns at a site such as ProPublica. Searching this database is free, and you do not have to enter any personal information to access it.

HCSMs do have several weaknesses. The programs favor healthy living over medical intervention. Maintenance drugs for illnesses like high blood pressure and diabetes may be excluded due to recognition of these as pre-existing conditions. Preventative medicine such as childhood immunizations, mammograms and colonoscopies are generally excluded.

HCSMs do have a morality exclusion for sharing medical expenses. If a disease is deemed to have occurred because of a violation of the morality exclusion, the ministry can refuse to share the cost of the illness. As a result of the morality clause, pregnancy outside of marriage, as well as diseases that could be related to drug, alcohol or tobacco, are generally excluded. Treatment for substance abuse and mental illness are also significantly limited by most plans. Additionally, there is no appeals process if a member is denied payment.

Some healthcare providers will refuse to accept payment from an HCSM and require payment up front. Demanding an upfront payment does not mean that the HCSM will refuse to pay. However, members may be faced with circumstances where they are either spending a lot of money up front, or they need to search for a healthcare provider that will accept payment from the HCSM.

Most HCSMs do not have prearranged agreements with healthcare providers like those that insurance companies offer. HCSMs encourage and sometimes require program participants to negotiate for discounts such as those provided to insurance companies. Some HCSMs will negotiate on behalf of the member, and some will leave the negotiation as a member responsibility. Hospitals and doctors have no obligation to reduce their prices in these circumstances, meaning that some may offer a discount, and some may not.

HCSMs are not without scandal: "Former officials of an Ohio ministry were ordered by a jury in 2004 to pay more than $14 million for embezzling member funds" (Armour, 2016). Reverend Howard Russell, the current President and CEO of Christian Healthcare Ministries, was instrumental in bringing to justice the criminal activity of the HCSM administrators in 2004. He has led significant reform at Christian Healthcare Ministries and initiated a governance system that has strengthened the integrity of the ministry. Christian Healthcare Ministries has become a good role model for other HCSMs to follow.

Healthcare remains a critical topic because people are continuing to need medical care and the cost of that care is not going down. More and more HCSMs are being created in what appears to be an attempt to take advantage of people's frustration with the traditional health insurance market. Some HCSMs are aggressively marketing their programs by advertising the low price of their plans in comparison to regular health insurance, but are not mentioning the original mission of following the example of Jesus Christ. In these instances, the Christian ministry of helping care for the sick by sharing the cost of medical care is being lost in the attempt to bring more people into the plans.

Former General Counsel of the Montana Insurance Department, attorney Christiana Goe stated, "When HCSMs begin marketing memberships in a way that makes it easy for individuals to join that do not share common religious beliefs, the HCSMs may lose touch with their original religious purpose, which was the basis for their legal exemptions from consumer protection laws" (Goe, 2018). Consumers should be wary of HCSMs that do not have Christian care as their primary mission. If an HCSM does not reference their mission in their advertisements, they are opening themselves up to being pursued by federal and state regulators for operating a non-licensed insurance company. Plus, if a state does have exemptions from insurance regulations, this does not prevent state attorney generals or private attorneys from pursuing civil litigation.

People that do not have a good understanding of the Christian faith and who do not understand the intent of the ministry should learn more about Christianity before entering an HCSM. If people are brought into the HCSM without being educated on the Christian faith, they are more than likely to be the ones to be disenchanted with the outcome and write negative posts or even initiate legal challenges to the HCSM. Hopefully, leaders of HCSMs will recognize their programs are growing not only to help people with their medical expenses, but also as an opportunity to spread the message of Jesus Christ—because people do find Jesus and let him into their heart in many unexpected places.

–Van Richards is a Christian financial advisor as well as the founder of https://www.Advice4LifeInsurance.com and http://www.Advice4Retirement.com. Van draws from his 30 years as a financial advisor to write about financial issues from a Christian perspective. You can contact him at van@advice4lifeinsurance.com.